Navigating life after college can seem daunting, even more so when you throw student loans into the mix. With more than 43 million Americans paying over $1.7 trillion on student loan debt, it makes sense that repayment is one of a college student’s or young professional’s defining financial burdens. However, managing Student Loan Repayment won’t have to consume you constantly with undue stress—having the right plans in place makes all the difference.

An effective repayment strategy allows you to safeguard your financial standing, strengthen your credit ratings, and advance toward long-term financial goals. This guide is tailored to equip you with the strategic approaches needed for a successful repayment journey.

Table of Contents

Understanding Your Student Loan Repayment Options

Federal vs. Private Loans – What’s the Difference?

Understanding the types of loans in your portfolio is one of the first steps needed to create an effective repayment plan. Traditional, federal student loans have a variety of repayment strategies.

Federal Loans:

- Issued by the U.S. Department of Education.

- Offer fixed interest rates, which tend to be lower than private loans.

- Eligibility for flexible repayment plans, loan forgiveness programs, and deferment or forbearance options.

Private Loans:

- Issued by banks, credit unions, or private lenders.

- Often have higher and variable interest rates.

- Fewer borrower protections and repayment flexibility compared to federal loans.

Please familiarize yourself with the details of your repayment agreements through your account with your loan servicer, and head over to their website for online access. This knowledge is instrumental in deciding your ideal repayment plan tailored to your situation.

Choosing the Right Repayment Plan

Federal loans come with numerous repayment options cut out to suit varying economic conditions. Check out below to find some of the most used repayment plans:

- Standard Repayment Plan: Monthly payments are fixed for borrowers looking to repay their loans within a decade, that’s 10 years.

- Income-Driven Repayment Plans (IDR) (Income-driven repayment plans are more flexible than other repayment options. They cap spending based on income and family size, which will benefit those who earn less or have an unpredictable income flow.

- Graduated Repayment Plan: This is also a great plan if you expect to earn more down the road: Graduated Repayment Plan. Payments start as low and increase over time.

- Extended Repayment Plan: It’s extendable up to 25 years. For those with larger loan amounts, repayment can be made in chunks, either at a fixed rate or graduated, making it easier to bear.

These payment plans are less flexible, so talk with your respective lenders. Pick a plan that suits your income, job security, and broader financial targets.

Top Strategies for Managing Your Student Loan Repayment

Automate Your Payments for Convenience and Discounts

Your loan servicer adds up over time. Most offer a measly interest reduction when you enroll in automatic payments. If you set it up, that’s one less thing to worry about! You’ll become more organized, less likely to miss deadlines, and escape late fees.

Take Advantage of Loan Forgiveness Programs

If you have federal loans, you may be eligible for loan forgiveness programs, which can cancel some or all of your debt. For example:

- Public Service Loan Forgiveness (PSLF) serves borrowers working in qualifying government or nonprofit jobs. If you have federal loans, some or most of your outstanding debt may be wiped clean with their forgiveness programs, and you could become eligible! Your remaining balance will be forgiven after you’ve made 120 qualifying payments.

- The Teacher Loan Forgiveness Program allows up to $17,500 in forgiveness for eligible teachers who taught at low-income schools.

Double-check that you complete all requirements, such as working full-time with a qualifying employer, and ensure all required documentation is submitted annually.

Consider Refinancing or Consolidating Your Loans

While refinancing or consolidating your loan might make repayment easier, the pros and cons should always be evaluated first.

- Refinancing, available only through private lenders, can save you money if it results in a lower interest rate, but you may lose federal benefits such as loan forgiveness.

- Consolidation merges several federal loans into one. While it sets a fixed interest rate and may extend the repayment term, it can result in more outstanding overall interest payments in the long run.

Refinancing works for borrowers with high credit scores and steady employment, while consolidation best serves those straddled with numerous federal loans

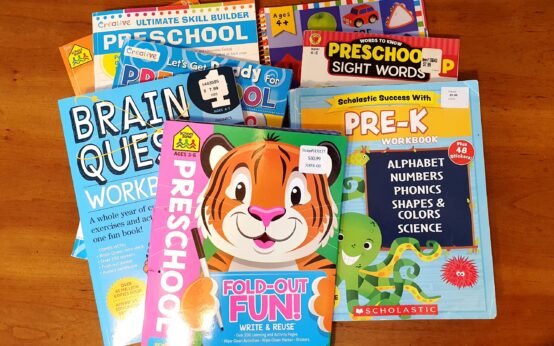

People Also Read: Top Pre-K Workbooks to Prepare Your Child for School

Common Pitfalls to Avoid in Your Student Loan Repayment Journey

Ignoring Your Loan Repayment

Missing payments or ignoring your loans can lead to loan default, damage your credit score, and lead to costly consequences like wage garnishment or lawsuit threats. Always stay responsive to your loan servicer and work toward a solution if you struggle to make payments. Options like deferment, forbearance, or income-driven repayment plans can help during tough times.

Failing to Reevaluate Your Repayment Plan

You should also adjust the repayment plan based on changes in the person’s financial situation. For example, if their income is increasing, it is advisable to change to a standard or graduated plan to pay off the loans quickly. If the situation worsens, they can consider income-driven plans or forbearance to manage payments. Revising your repayment plan periodically can conserve resources and time.

How to Stay on Track with Your Student Loan Repayment

Set Financial Goals to Track Progress

Setting financial goals makes it easier to keep track of and remain motivated. For instance:

- Short-term goals: Building an emergency fund that can cover expenses for 3-6 months.

- Long-term goals: Establishing a time limit for the loans to be paid off.

Tracking the balance is easier with the budget apps Mint and YNAB (You Need a Budget) or through other loan-tracking-specific software. Witnessing the balance lower is highly motivational.

Seek Professional Help if Necessary

If dealing with the burden of tracking student loans becomes too tiresome, finding a financial advisor or student loan consultant may assist with repayment plan options, refinancing analysis, new offers, or other specialized help.

Take Control of Your Student Loans Today

Managing student loans can be tedious; however, being organized means anyone can retain financial stability alongside pressure-free repayments. To manage your debt responsibly, it is essential to understand your loan options, choose the most suitable repayment strategy, and implement techniques like automation or forgiveness.

Your repayment plan can always be modified to reflect changes in your circumstances; feel free to shift it based on your finances. Today, decide to review your loans and apply these suggestions to enhance your financial outlook.

Need additional resources? Visit Now for tools to help you repay your student loan.

Stay Informed with Trending Stories – Join Our Newsletter Today!

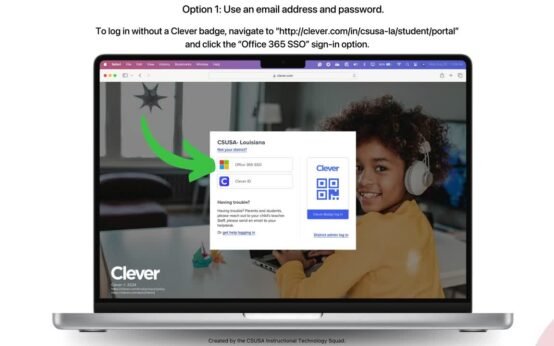

How Clever CSUSA is Revolutionizing Education in the USA

How Clever CSUSA is Revolutionizing Education in the USA  Top Pre K Workbooks to Prepare Your Child for School

Top Pre K Workbooks to Prepare Your Child for School  Exploring Box WUSTL: A Game Changer for WashU Tech

Exploring Box WUSTL: A Game Changer for WashU Tech  Best UK Cities for Indian Students in 2025: Top 5 Picks

Best UK Cities for Indian Students in 2025: Top 5 Picks  How Classroom 15x Is Revolutionizing Modern Learning

How Classroom 15x Is Revolutionizing Modern Learning